The pound has slumped to its lowest for more than a year, with UK borrowing costs hitting their highest for 16 years. Economists have cautioned that the surge in expenses could lead to additional tax increases or spending cuts as the government seeks to adhere to a self-imposed rule not to borrow to pay for day-to-day expenses.

Responding to an urgent question in the Commons, Treasury minister Darren Jones said that there was “no need for an emergency intervention” in financial markets. Markets “continue to function in an orderly way” and movements in the costs of government borrowing were being driven by “a wide range of international and domestic factors,” he added.

Fluctuating Pound and Borrowing Costs Amid Economic Concerns

Jones said it was natural for prices to fluctuate “when there are broader movements in global financial markets, including to economic data” and the government’s minimal willingness to borrow for non-investment was “non-negotiable”.

Shadow chancellor Mel Stride added: “The government’s decision to let rip on borrowing means that their own tax rises will be swallowed up by the higher borrowing costs, providing no benefit to the British people.”

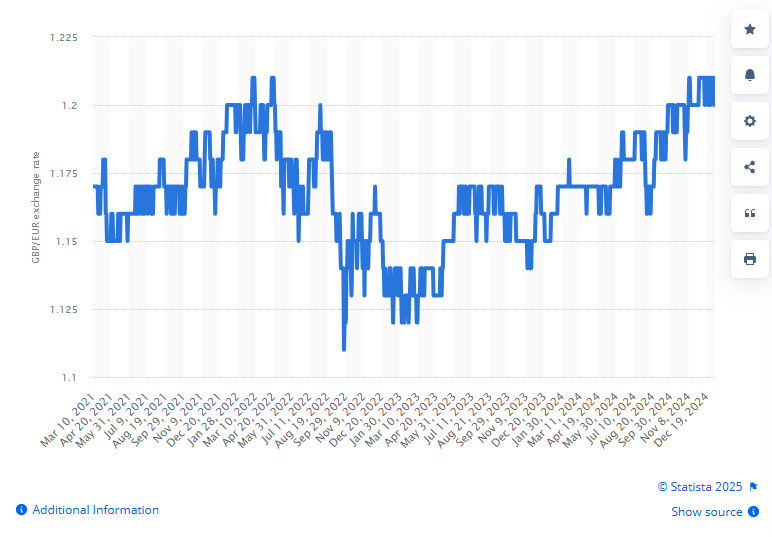

The pound dropped 0.9 percent to $1.226 against the dollar on Thursday and borrowing costs also climbed.

The pound tends to gain as borrowing costs increase, but economists said broader worries about the health of the UK economy had pushed it lower.

Rising Borrowing Costs Strain Government Revenue

The government spends more than it collects in tax, as a rule. To bridge this shortfall it takes out loans, but those must be repaid — with interest. One way it can borrow money is through the sale of financial products known as bonds.

How much money is the UK government borrowing and does that matter?

The increase in borrowing costs has meant that the amount of interest the government pays on its debt rises and “eats up more of the tax revenue, leaving less for other things”, Mohamed El-Erian, chief economic advisor at asset manager Allianz, told the BBC’s Today programme. It can also suppress economic growth, he added, “which also undermines revenue”.

“So the chancellor, if this keeps going, is going to have to consider either raising taxes or even more cutting spending — and that’s going to hit everybody,”